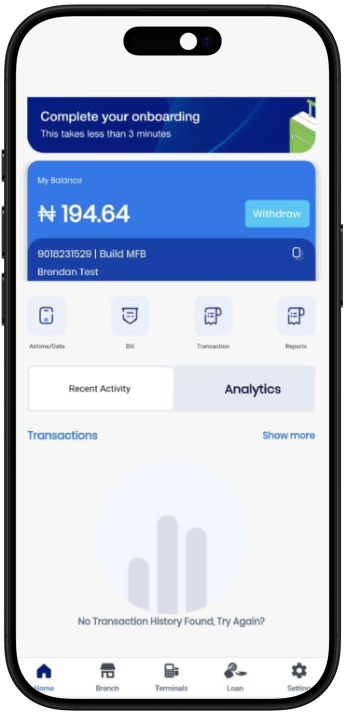

It offers a robust platform that integrates essential banking services such as loans, deposits, withdrawals, and bill payments, all tailored to meet the unique needs of SME users.

By leveraging advanced technology and a user-friendly interface, Visum empowers users to efficiently manage their financial transactions while ensuring security and reliability.

Visum provides a one-stop solution for essential banking services including loan applications, deposits, withdrawals, and bill payments. This integration ensures users and businesses have all necessary financial tools at their fingertips.

Merchants can manage multiple business branches through Visum, with each branch having unique account features and a branch TID. The Head Office benefits from a consolidated 360° management view of all branches registered under it, allowing for effective oversight and control.

The platform is designed with ease of use in mind, featuring an intuitive interface that allows users to navigate and complete transactions with minimal effort.

Visum is accessible via mobile app, web app, and all-android POS terminals. All platforms are connected and synchronized, ensuring that transactions and data are consistent across a single store or multiple stores, depending on the merchant's setup.

Transactions made through Visum are processed in real-time, ensuring that users can manage their finances efficiently without delays.

Visum incorporates advanced security measures, including encryption and multi-factor authentication, to protect user data and prevent fraud.

Merchants can customize the system for auto-settlement and disbursement of funds based on their business operation needs, ensuring that their financial workflows are optimized and aligned with their specific requirements.

This feature allows app and POS users to track the real-time uptime of banks' networks, enabling them to make informed business transactions by understanding the current status of banking networks for both Cards and NIP related transactions..

Users can set up alerts for transaction confirmations, low balances, and other critical account activities, helping them stay on top of their financial management.

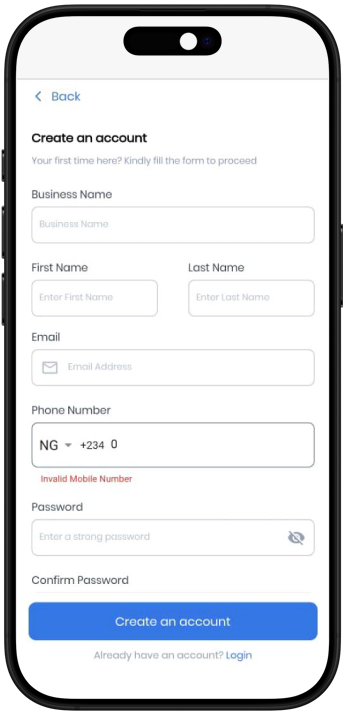

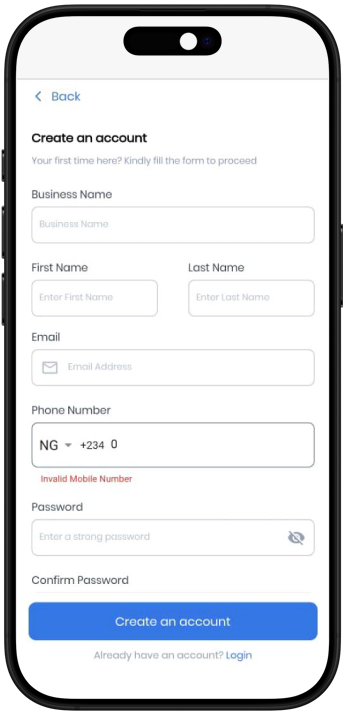

Follow these simple steps to get started

Begin your registration process by visiting the official Visum website. Here, you will find the agent registration form that you need to fill out to get started, or download the Visum mobile application from the Play Store and select "Sign Up" to proceed.

Complete the registration form by entering your full name, email address, phone number, and other required details. Ensure all information provided is accurate to facilitate a smooth registration process.

After filling in all the necessary information, click the submit button to proceed. Your details will be reviewed, and a merchant account will be created for you upon successful submission.

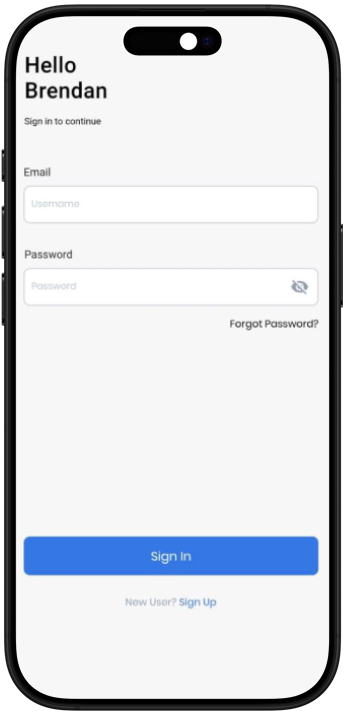

Once your account is created, you can log in to your account dashboard either online through the Visum website or via the Visum mobile app. This will give you access to start managing your business transactions through Visum.

To finalize your registration and fulfill the KYC (Know Your Customer) requirements, you will need to provide the following documents:

A recognized form of ID such as an international passport, National Identification Number (NIN), voter's card, or driver's license.

A recent utility bill (e.g., waste bill, electricity bill) that verifies your residential address.

For registered businesses, submit your Corporate Affairs Commission (CAC) documents as proof of business registration.

Your BVN is required to verify your identity and financial standing.

Accessing Visum is easy and straight forward and can be done via any of the following means

Access Visum through the official web portal by entering your registered email and password. The platform supports secure logins through multi-factor authentication.

Download the Visum mobile app from the App Store or Google Play Store. Log in using your credentials to access your account on the go.

If you're using an all-android POS terminal, it can be synced with your Visum account to process payments and manage transactions directly through the device.